Like most Australians, you probably assume you will not be able to access your superannuation until retirement.

Depending on what stage of life you’re at, retirement can be a long way off. But life, as we know, is unpredictable.

So what happens if a significant life change leaves you in need of financial assistance? Can you access your super early?

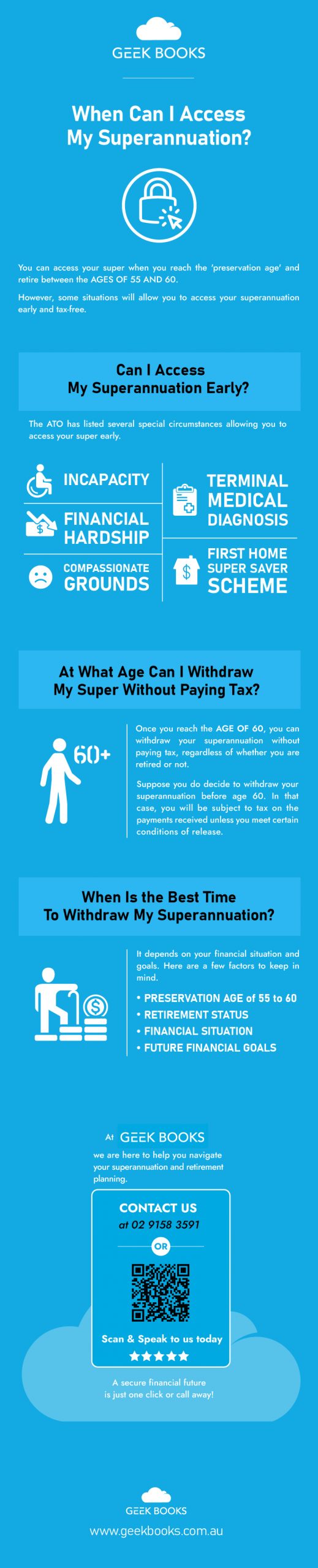

In such a situation, a common question many ask is, “when can I access my superannuation in Australia?” You can access your super when you reach the ‘preservation age’ and retire between the ages of 55 and 60.

Preservation age refers to the age at which an individual can access their superannuation in Australia.

The preservation age is a minimum age set by the government and helps to ensure that individuals don’t withdraw their superannuation too early before retirement age.

However, some situations will allow you to access your superannuation early and tax-free. This guide will look at the following:

- When can I access my superannuation early?

- When can I access my superannuation tax-free?

- When is the best time to withdraw my super?

Can I Access My Superannuation Early?

In some limited circumstances, you may be able to access your super benefits earlier than the preservation age.

Remember that if you access your super benefits early, it may affect your retirement income or have tax implications.

Consult with one of our expert superannuation strategists at GeekBooks to get the latest and best financial advice.

The ATO has listed several special circumstances allowing you to access your super early. The ATO assesses these claims for eligibility.

Let’s take a look at five of these eligibility requirements.

Incapacity

You may be able to access your superannuation early if you have a permanent physical or mental incapacity that prevents you from working.

This “condition of release” provides financial support for individuals unable to work due to a disability.

To access your super on the grounds of permanent incapacity, you will need to provide medical evidence that verifies your condition.

A medical practitioner, such as a doctor or specialist, can provide this evidence.

Financial Hardship

Severe financial hardship is another reason you can access your superannuation early in Australia.

This option is usually only available if you receive one or more qualifying government benefits, such as the Newstart Allowance, Youth Allowance, Disability Support Pension, or Parenting Payment.

To access your superannuation on the grounds of severe financial hardship, you will need to provide evidence that you have received the relevant government benefit for at least 26 weeks.

Under these grounds, you can only make one super withdrawal in a 12-month period.

Compassionate Grounds

If you are facing unexpected and exceptional expenses, such as medical treatment or modifying your home to accommodate a severe disability, you may be able to access your super funds on compassionate grounds.

To access your superannuation on compassionate grounds, you must provide evidence of the exceptional circumstances causing the financial hardship and the expenses that need to be covered.

Terminal Medical Diagnosis

If you have been diagnosed with a terminal illness and your life expectancy is less than two years, you may be able to access your superannuation funds before retirement age.

To access your superannuation on the grounds of a terminal medical diagnosis, you will need to provide medical evidence from two medical practitioners, including a specialist, confirming your diagnosis and life expectancy.

First Home Super Saver Scheme

The First Home Super Saver Scheme (FHSSS) is a government initiative that allows individuals to access their super early to save for a first home.

The scheme enables eligible first-home buyers to withdraw voluntary super contributions they made since July 1, 2017, to help purchase their first home.

To be eligible for the FHSSS, individuals must

- Not have previously owned property in Australia.

- Not have previously released any superannuation under the FHSSS.

- Meet the eligibility criteria for the scheme, such as the age and residency requirements.

- Meet the criteria for the scheme. Criteria include contribution requirements and intent to live at the property as soon as possible.

As of July 1, 2022, individuals can apply to the ATO to withdraw up to $50,000 of their voluntary contributions for a first home deposit.

The contributions and earnings withdrawn will be taxed at the individual’s marginal tax rate, less a 30% tax offset.

At What Age Can I Withdraw My Super Without Paying Tax?

Like many other Australians, have you wondered, when can I access my superannuation tax-free?

Once you reach the age of 60, you can withdraw your superannuation without paying tax, regardless of whether you are retired or not.

This withdrawal is possible because the government considers you to be of preservation age and, therefore, eligible for tax-free withdrawals from your super.

Suppose you do decide to withdraw your superannuation before age 60.

In that case, you will be subject to tax on the payments received unless you meet certain conditions of release, such as permanent incapacity, severe financial hardship, or a terminal medical condition. In these situations, the payments will be tax-free.

When Is the Best Time To Withdraw My Superannuation?

The best time to withdraw your superannuation in Australia depends on your financial situation and goals. Here are a few factors to keep in mind.

- Preservation age. As mentioned earlier, you can access your super payments once you reach the preservation age of 55 to 60. However, waiting until you are 60 or over can help you avoid paying taxes on your withdrawals.

- Retirement status. If you are retired, you can access your super anytime, regardless of age. However, if you are still working, you may want to wait until you reach your preservation age before transitioning to your retirement income stream.

- Financial situation. If you are facing financial hardship and require immediate access to funds, you can apply to access your super early.

- Future financial goals. Are you planning on using your superannuation to purchase a home or invest in other long-term goals? If so, waiting until you are closer to retirement or have reached the preservation age is beneficial before withdrawing your funds.

Ideally, waiting until the preservation age to withdraw your super is recommended, as the early release of super affects your retirement savings.

However, if extenuating circumstances mean you need to access your super early, please consider the key factors discussed in this guide.

At GeekBooks, we are here to help you navigate your superannuation and retirement planning.

Complete our online booking form or call us on 02 9158 3591. A secure financial future is just one click or call away!