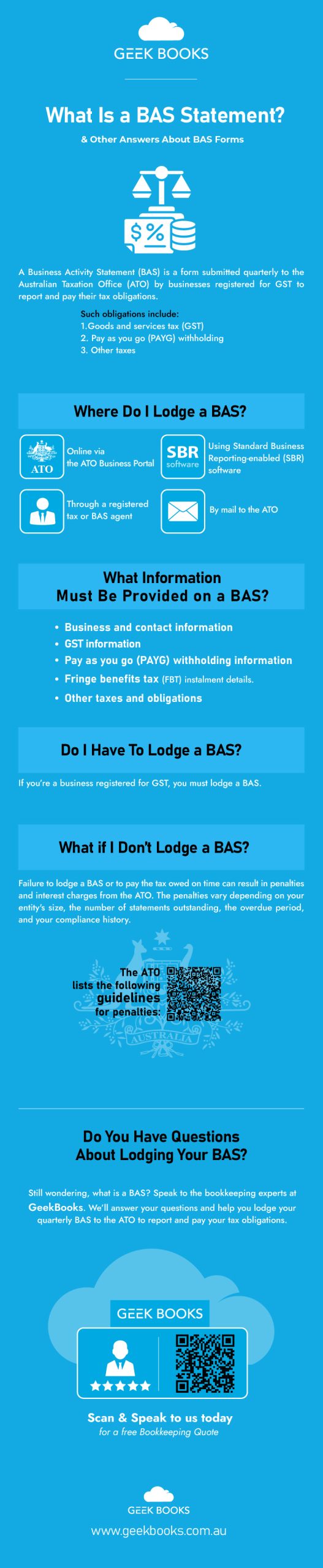

A Business Activity Statement (BAS) is a form submitted quarterly to the Australian Taxation Office (ATO) by businesses registered for GST to report and pay their tax obligations.

Such obligations include

- Goods and services tax (GST)

- Pay as you go (PAYG) withholding

- Other taxes

If you’re a business owner wondering what is included in a BAS, read on for the answers.

Where Do I Lodge a BAS?

You can lodge a BAS in several ways:

- Online via the ATO Business Portal

- Using Standard Business Reporting-enabled (SBR) software

- Through a registered tax or BAS agent

- By mail to the ATO

What Information Must Be Provided on a BAS?

When completing a BAS, you must provide this information:

- Business and contact information, including your Australian Business Number (ABN) and reporting period.

- GST information, including sales, purchases, and GST payable and receivable.

- Pay as you go (PAYG) withholding information, including tax withheld from employee wages and salaries.

- Fringe benefits tax (FBT) instalment details.

- Other taxes and obligations, including luxury car tax, wine equalisation tax, fuel tax credits, and taxable payments reporting for the building and construction industry.

Do I Have To Lodge a BAS?

If you’re a business registered for GST, you must lodge a BAS. Your business must register for GST if its annual turnover is $75,000 or more or is expected to reach that threshold.

When you register for an ABN and GST, the ATO will automatically send you a BAS when it’s time to lodge.

Your business must also lodge a BAS if you have a withholding obligation, such as PAYG withholding from employee wages and salaries.

If you have other tax obligations, such as luxury car tax, wine equalisation tax, fuel tax credits, or taxable payments reporting for the building and construction industry, you’re required to lodge a BAS.

What if I Don’t Lodge a BAS?

Failure to lodge a BAS or to pay the tax owed on time can result in penalties and interest charges from the ATO. The penalties vary depending on your entity’s size, the number of statements outstanding, the overdue period, and your compliance history.

The ATO lists the following guidelines for penalties:

“For small entities (annual turnover of less than $1 million), the failure to lodge (FTL) penalty is calculated at the rate of one penalty unit for each period of 28 days (or part thereof) that the return or statement is overdue, up to a maximum of five penalty units.

A ‘medium entity’ qualifies as a medium withholder for PAYG withholding purposes or has assessable income or current GST turnover of between $1 million and $20 million.For medium entities, the FLT penalty unit is multiplied by two.

A ‘large entity’ qualifies as a large withholder for PAYG withholding purposes or has assessable income or current GST turnover of $20 million or more. For large entities, the penalty unit is multiplied by five.”

The penalty units are calculated by the ATO as follows:

| When the Infringement Occurred | Penalty Unit Amount |

|---|---|

| On or after 1 January 2023 | $275 |

| 1 July 2020 – 31 December 2022 | $222 |

| 1 July 2017 – 30 June 2020 | $210 |

| 31 July 2015 – 30 June 2017 | $180 |

| 28 December 2012 – 30 July 2015 | $170 |

| Up to 27 December 2012 | $110 |

However, the ATO understands that taxpayers may face challenges in lodging or paying their BAS by the due date.

In such cases, they advise you to contact them as soon as possible before the due date, and they’ll work with you to find a solution.

Do You Have Questions About Lodging Your BAS?

Still wondering, what is a BAS? Speak to the bookkeeping experts at GeekBooks.

We’ll answer your questions and help you lodge your quarterly BAS to the ATO to report and pay your tax obligations.

Complete our online booking form or call us on 02 9158 3591 for a free bookkeeping quote today!