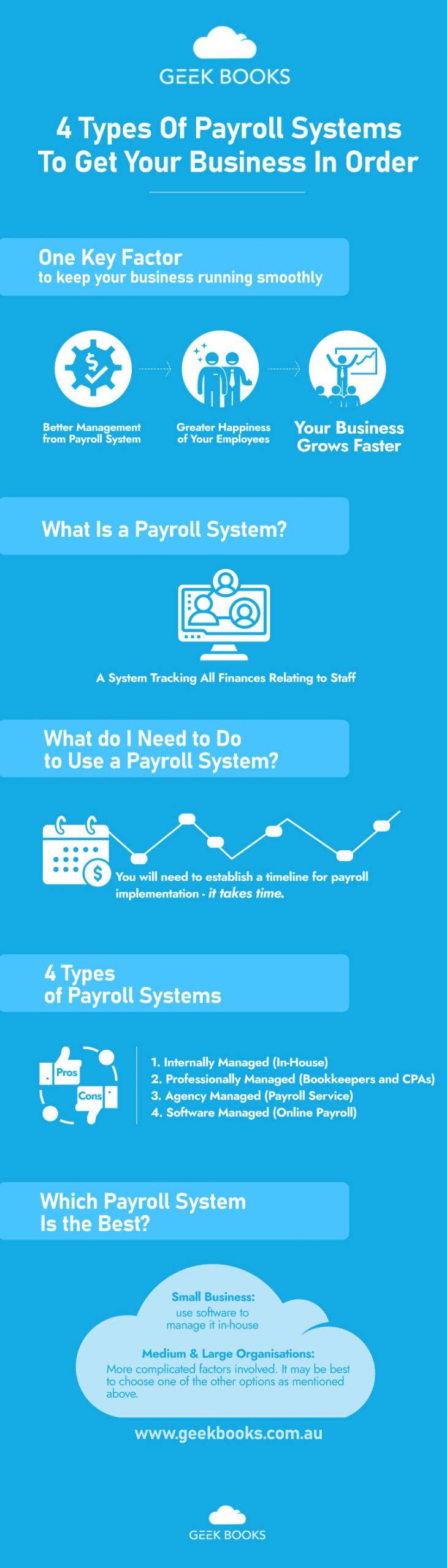

When you are running a business, there are various things you need to stay on top of.

It is just as important to keep your employees happy as it is to keep track of business functions – there is much to do to keep your business running smoothly.

One key factor that determines the happiness of your employees is your management of the business payroll.

This is about more than merely maintaining a record of the salary paid to each employee; it is a comprehensive system covering things like taxes, pensions, benefits and many other factors relating to paying your staff.

To help you understand more about how you can do a good job with your company payroll, we have compiled this guide with a list of payroll systems used by modern businesses.

What Is a Payroll System?

Payroll systems came about as business owners began to recognise the need to track all finances relating to staff.

A payroll system is an application that streamlines and manages employee payments.

Furthermore, in Australia, businesses must pay a tax based on the money they pay to employees when their total wage payouts cross a certain threshold (this varies between different regions).

A good payroll system can track the number of hours each employee works, account for rates of pay and calculate taxes and other deductions to provide an accurate figure for hour much each employee should be paid.

They can also track attendance, manage time off requests, calculate your tax obligations, manage expenses and much, much more.

When properly implemented, you will keep your employees happy with accurate, timely payments and payslips, and you will manage even the most complex of payroll obligations with an automated system that requires minimal maintenance.

What’s more, you can outsource the management of it to give yourself even more time to focus on what’s really important.

It is essential to deploy payroll tax software to:

- Take the stress out of audits

- Maintain compliance with current tax legislation

- Ensure all employees are paid on tie

- Avoid costly penalties associated with getting payroll tax wrong

What do I need to do to use a payroll system?

You will need to establish a timeline for payroll implementation – it takes time.

The further into the tax year you are, the more data there will be to input.

You will need to prepare yourself for parallel pay runs and ready yourself for a lot of data entry. If you are the payroll manager, you could outsource the implementation to take some of that burden off your shoulders, with the added bonus of having expertise to oversee the implementation.

4 Types of Payroll Systems (+ Pros & Cons)

Payroll systems come in different forms.

The main difference is the way they are implemented and managed, so you need to consider the options and choose the one that works for you.

1. Internally Managed (In-House)

This is most feasible for a business with fewer employees.

You manage it yourself, and fewer employees means less space for major discrepancies to creep in.

With internally managed systems, one of the employees in your business takes responsibility for payroll.

That individual must keep on top of staff changes and be up-to-date with payroll tax laws for things like accurate pay, tax withholding and filing.

They then use the software to maintain and manage the business payroll.

These systems are:

- Best for smaller businesses

- Designed to make payroll processes straightforward

- Fully compliant with the latest tax legislation

- Simplified for use by non-experts

Pros of In House Payroll

- Eliminates major discrepancies with small staff

- Can be done in-house, so keeps costs down

- Low security risk by managing data in-house

- Intuitive tools make payroll processes simple

Cons of In House Payroll

- Not suitable for businesses with more than 10 employees

- Payroll not managed by an expert/professional

- Takes up employees’ time

2. Professionally Managed (Bookkeepers and CPAs)

Payroll can be outsourced to a bookkeeper or certified public accountant (CPA).

This saves you time and ensures you have real expertise in charge of your payroll, plus it is better suited to growing or larger businesses.

With a professionally managed system, you have someone with expertise in all the services you require.

Processing errors will be virtually eliminated, but you remain ultimately responsible for accurate deposit and payment of tax liabilities.

It is you that will be contacted if there are any issues, not the payroll service.

You will need to provide the data to be input into the system, but most of the burden is lifted from you, enabling you to focus on your operations with peace of mind.

With a professionally managed payroll system:

- Medium-large businesses can have payroll operations covered

- You have a professional in charge of payroll management

- Your employees can focus more on core business operations

- You get a bespoke system for your needs

- You are still liable if tax authorities have any issues

Pros of Bookkeepers/CPA Payroll

- Suitable for medium-sized businesses

- Expert management of your payroll

- Fully-featured, bespoke system tailored to your needs

- Work is outsourced, enabling your employees to focus on business operations

- There are affordable solutions to choose from

Cons of Bookkeepers/CPA Payroll

- Bookkeepers/CPAs will not carry out transactions, bank deposits and deductions

- Outsourcing to professionals costs money

3. Agency Managed (Payroll Service)

As an alternative outsourcing option, you can hire a payroll services agency to manage your payroll.

They will take on all payroll responsibilities for your company.

With agency managed payroll services, all your payroll obligations as well as salary deposits and deductions will be handled on your behalf.

You will get assurance of absolute accuracy and avoidance of late payments.

Agencies provide well-informed experts to give you peace of mind and ensure full compliance, covering administrative tasks and guarantees on their work.

Agency managed payroll services:

- Provide a team of experts to manage your payroll

- Cover all things related to your company payroll

- Are suitable for large businesses with many employees

- Offer guarantees for timely payments and accurate filing

Pros of a Payroll Service

- Suitable for larger organisations

- Cover core payroll processes and other associated tasks

- Guarantee accuracy and punctuality

- Provide peace of mind with compliance

Cons of a Payroll Service

- Expensive option

- Give you less control over your systems

4. Software Managed (Online Payroll)

These are growing in popularity, providing an online portal through which you can manage your payroll with the help of automation tools.

You handle the data entry and the software does everything else for you, all based in the cloud.

Online payroll gives you access to your payroll details 24/7 via a secure web portal, with no additional software or equipment to buy.

All the tools and features of the software are optimised for your payroll and hosted online, enabling you to track employee hours, vacations and sick days from your laptop.

Online tax filing and reporting, as well as payments and other payroll-related services, are often provided.

Software managed payroll systems:

- Provide tools and resources hosted in the cloud

- Require you to enter data into the system regularly

- Carry out calculations and produce reports with powerful automation

- Include support for if you encounter any issues

- Take much of the complexity out of payroll

- Are available via subscriptions

Pros of Online Payroll

- No need to purchase software or equipment to run it

- Automation features and excellent options for reporting

- Often integrate with HR and accounting systems for a complete solution

- Simple, user-friendly interfaces for ease of use

- Affordable in monthly subscription plans

- Available in packages to suit your needs, with scalable options

Cons of Online Payroll

- Requires data entry admin work from you/an employee

- Not managed by a professional, so still margin for error

Which payroll system is the best?

When it comes to choosing the most efficient way to manage our payroll, there are many options available to you.

If you are a small business and you or someone in your business has a base understanding of payroll management, you can use software to manage it in-house.

For medium and large organisations, it may be best to choose one of the other options.

You must consider factors like budget and the complexity of your payroll – these will tell you which option is the best fit for you.

Geek Books are an accounting and bookkeeping firm that allow you to outsource your payroll to ensure accurate and timely execution of taxes and payroll operations.

Our expertise in tax legislation and the use of professional software enables us to offer maximum accuracy and take the daunting task of managing payroll off your shoulders.

If you would like to learn more about how we can help, please contact us and get started.