Virtual Accountants

Many companies are discovering that a virtual accountant offers significant advantages over hiring a real-life bookkeeper

Be assured with our 30 day money back guarantee.

We are ready to chat wITH YOU!

Learn More About How We Can Help With Virtual Accountants

There Has Never Been a Better Time for an Online Accountant

From technological advances through to changing working practices, outsourcing various key functions to external agencies has become commonplace. Most companies wouldn’t expect to employ a full-time solicitor to deal with legal matters, for example, or a dedicated IT team member when their tech requirements can be met more cost-effectively elsewhere.

Bookkeeping is no different. However, some businesses may still have concerns or questions about virtual bookkeeping services, particularly if they are considering virtual accounting solutions for the first time.

Here we take a look at the key benefits which virtual accounting can bring to your enterprise, along with various common queries you might have. Read on to discover the surprising ways Geekbooks could transform the way you work, as well as information on everything from security to task management.

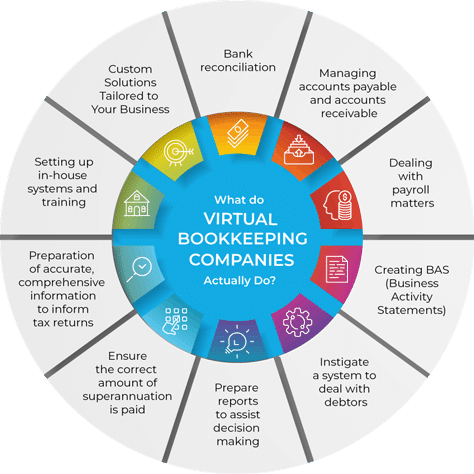

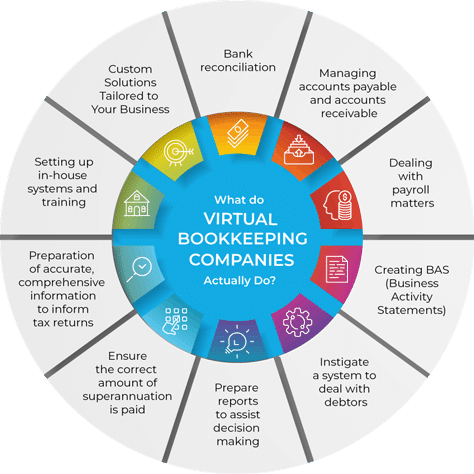

What Do Virtual Bookkeeping Companies Actually Do?

Every business requires purchases in order to operate. From utilities through to tools, fuel for corporate vehicles, materials, travel costs or stationery, your enterprise is both a vendor to customers and a customer in its own right. Accounts payable are the accounts which a business has with its suppliers. Some accounts payable will be settled on a monthly basis; others will be ad hoc purchases; or larger amounts which are to be paid on an instalment plan. Keeping track of how much is owed and when it needs to be paid is essential in order to:

Bank Reconciliation

Checking that your financial records tally with your business bank statements.

Managing Accounts Payable & Receivable

A key bookkeeping function is to ensure that invoices are sent out and payments received are process correctly.

Dealing With Payroll Matters

Bookkeepers manage your payroll accurately and in line with all relevant legislation.

Creating BAS (Business Activity Statements)

As required by the ATO, a virtual accountant will prepare and send off appropriate BAS in a timely manner.

Instigate A System To Deal With Debtors

Almost every business occasionally encounters customers who can't (or won't) pay for the goods or services they've received. In the first instance, bookkeepers will send out reminders, as well as flag up the debtor for potential additional action.

Prepare Appropriate Financial Reports To Inform Decision-making

Preparation of accurate, comprehensive information to inform tax returns. Note that you may need a virtual tax accountant to complete your tax return, particularly if you have complex financial circumstances.

Why Are Businesses Outsourcing Their Bookkeeping?

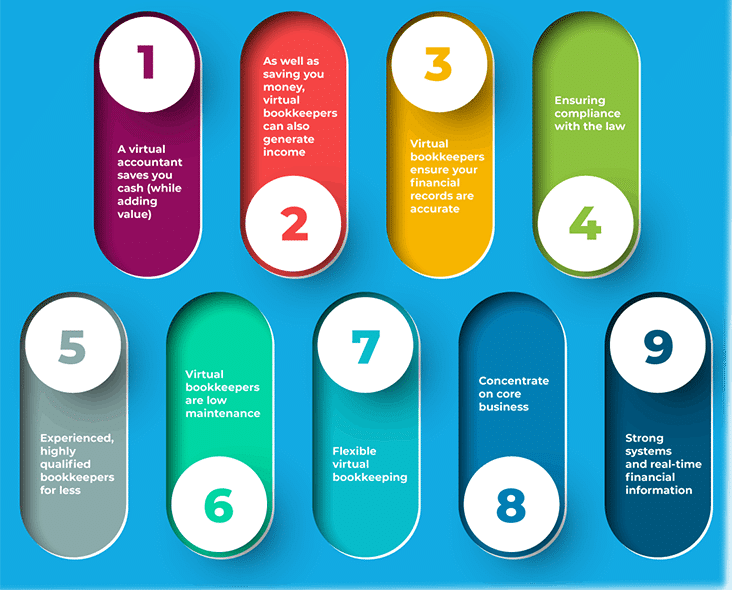

Figures suggest that outsourcing their bookkeeping function is becoming an increasingly attractive option for businesses of all shapes and sizes. Particularly popular with small and medium enterprises (SMEs), virtual bookkeeping can bring significant advantages. Here we take a look at the main reasons businesses are deciding that virtual accounting services are the way forward.

Virtual Bookkeepers Can Generate Direct & Indirect Income

A skilled bookkeeper will pick up on errors, non-payments and other irregularities which could result in additional income. From incorrect bank charges through to spotting customers who haven’t paid, bookkeepers will do their utmost to ensure you get every cent that’s due to you.

Good-quality financial information is the backbone of sound financial decision-making. Armed with the correct figures, you and your SMT (senior management team) are in a far stronger position to make the right choices for optimal business success.

Save yourself some fines! A late tax return could see you incur a financial penalty from ATO. Bookkeepers have a key role in ensuring your information is ready to complete your tax return on time.

Virtual bookkeepers ensure your financial records are accurate

One of the strengths of a bookkeeper is their love of detail! When you contract with a virtual bookkeeper, you can expect financial records and reporting that is 100% accurate. Geekbooks’ bookkeepers will trawl through your books with a fine-toothed comb, identifying every irregularity and making sure it’s resolved.

One of the strengths of a bookkeeper is their love of detail! When you contract with a virtual bookkeeper, you can expect financial records and reporting that is 100% accurate. Geekbooks’ bookkeepers will trawl through your books with a fine-toothed comb, identifying every irregularity and making sure it’s resolved.

Ensuring Compliance With the Law

While most business owners are aware of the basic financial tasks they need to do in order to stay compliant, they may not be aware of recent changes, or requirements in every aspect of their financial record keeping.

For virtual bookkeepers, ensuring they’re up-to-date with all relevant requirements is always a priority. This means that when new requirements come on stream, your bookkeeper will know what’s needed and ensure it’s in place.

For example, it’s surprising how many people aren’t aware that, in Australia, it is a legal requirement to inform the Australian Tax Office of payroll for Single Touch Payroll. Do you know if your business is compliant? When you use a virtual bookkeeper there are no unpleasant surprises – your financial record keeping will be 100% compliant and 100% accurate on all counts.

Experienced, Highly Qualified Bookkeepers for Less

When you contract with an online bookkeeping service, you'll be getting work completed by a time-served, certified and fully qualified bookkeeper. This means you'll be enjoying a premium bookkeeping service for a relatively small outlay. A good bookkeeper will do far more than simply sort out your record-keeping; they'll also be alerting you to any areas of financial concern, as well as pro-actively suggesting ways you may be able to reduce costs or even improve turnover. A good bookkeeper will be able to tell you when accountancy expertise may be needed, in addition to bookkeeping skills.

Concentration on Core Business

Particularly for smaller businesses, or those that have been painstakingly grown from a start-up, letting go of financial record keeping can feel intimidating: being able to trust others to do what you’ve been doing for a while isn’t always easy. The benefit of handing across your bookkeeping to a professional, virtual bookkeeping service like Geekbooks is that it leaves you free to concentrate on other aspects of your business. Professional bookkeepers will provide you with consistently accurate, dependable data. They know what’s needed to ensure your business is compliant and has all the financial data necessary to meet key goals and strategic objectives. Although initially, letting go of tasks you’d previously completed can be a challenge, most business owners quickly discover the advantages of being able to entrust their record-keeping to a dependable, out-sourced provider.

Managing staff takes time; explaining tasks to staff takes time; dealing with staff HR matters takes time. A virtual bookkeeper requires none of these activities.

When you hire a virtual bookkeeper, they come to you fully trained, inducted and aware of your current software/requirements/ goals. You’re not required to monitor or support them in any way.

Once it’s clear what’s needed, a virtual bookkeeper will go about completing the required tasks to an impeccable standard.

BOOKKEEPING IS AN OUT-SOURCED ACTIVITY WHICH REQUIRES MINIMAL CONTRACT MANAGEMENT -

WE DO THE HARD WORK SO THAT YOU DON'T HAVE TO!

Strong Systems & Real-time Information

It’s surprising how many business owners still do their own bookkeeping, along with all the other tasks needed to run a successful venture. Inevitably, if an owner has to keep financial records as well as everything else, they may not be as up-to-date as desired. It’s all too easy for invoices to accumulate, or bank statements to remain unchecked for months. Falling behind on record-keeping increases the possibility of error or omission – receipts can get lost or a non-paying account may be overlooked. A virtual bookkeeper can change that: not only do they ensure your financial records are up-to-date, they can also put in place strong, transparent and user-friendly financial systems. Particularly if you’ve previously operated with ad hoc systems (the glove box of your company’s van as a repository for receipts to be filed at some point, for example, or hand-written invoices that may (or may not) be recorded as sent out – these practices do happen), the positive difference which a virtual bookkeeper can make is enormous.

Simple, reliable systems make life easier, as well as ensuring your financial information is robust and compliant. Up-to-the-minute financial data provides a valuable snapshot of your business’s effectiveness. It allows fast operational change to ensure you’re optimising opportunities and/or resolving glitches or areas of your business which aren’t performing as well as they might. Pro-active, rapid action is crucial in ensuring your company is best placed to meet your customers’ needs; virtual bookkeeping gives you the data required to act with confidence, sure that the information on which you’re basing decisions is accurate and complete.

Flexible Virtual Bookkeeping

One of the key challenges for any enterprise is coordinating supply and demand, and bookkeeping is no different. Taking on new employees, setting up fresh financial processes or training staff members in your bookkeeping methods may mean you require more bookkeeping input than usual. If you use virtual bookkeeping services, gaining additional input is fast and straight-forward. Similarly, if you find that you're in a good routine with your bookkeeping and need less support, you can request fewer hours. A major strength of virtual accounting is its customer-friendly focus: we are here to meet your needs, accommodating your workload no matter how big or small it might be.

Common Queries About Hiring Virtual Accountants

In many circumstances, the two terms are interchangeable. On a technical level, bookkeepers predominantly focus on record-keeping: their key task is to ensure smoothly operating financial systems and processes that create accurate, reliable financial data.

They are also able to provide a degree of data analysis, adding value to decision-making processes. In comparison, an accountant tends to focus on tax efficiency in all its forms. Accountants aim to save clients money on their tax bill through a range of strategies. These range from short-term assistance with annual tax returns through to in-depth, longer-term strategies for wealth creation.

A good bookkeeper will recommend when they think you might benefit from accounting services, or when a financial task is beyond their remit; similarly, an accountant will tell you when a bookkeeper is needed to ensure your data is of suitable calibre for the ATO and other interested parties.

Data security matters! As well as the ethical need to protect the financial and personal data of your workforce and business, your customers’ data must also be protected.

This is why Geekbooks uses state-of-the-art software and advanced encryption tools to ensure the security of your information. We have invested heavily in technology which is designed to optimise data security at every stage of the information journey.

We work with both XERO and MYOB – widely acclaimed platforms that put user security first. If you have any concerns about security or want further information, we are happy to help.

The short answer is that any business, in any sector, can take advantage of the benefits which a virtual bookkeeping service can bring. The principles of bookkeeping are universal and cross-cutting: every business will need to keep records of its income and expenditure, as well as make sure that bills are paid, workers are paid, appropriate financial information is prepared for submission to ATO and that there are suitable financial systems in place.

This commonality means that virtual bookkeepers can work successfully with a wide range of enterprises. We have public, private and not-for-profit ventures on our books – if you need a bookkeeper, we’re here for you! As we operate commonly utilised software, it’s highly unlikely that we’ll be unable to meet your needs.

As well as providing a one-stop solution for businesses that wish to outsource all their bookkeeping, we are also able to work in partnership with in-house bookkeepers: some companies use us just for payroll matters, for example.

Accountability and Management

The good news about using virtual accounting companies is that there are minimal monitoring and management required. Beyond the normal requirements of contract management, a virtual bookkeeper can be relied on to produce the data you need and maintain your books in an acceptable fashion without further input.

This makes them an ideal choice for busy business owners who need to hand over responsibility for creating high-calibre financial data to a reputable, dependable, source.

Start Enjoying the Advantages of Virtual Accountants

Fully certified and approved by the Tax Practitioners Board, we offer some of the best virtual bookkeeping services you’ll find in the country. As an established, dynamic team of bookkeeping professionals, we’re committed to ensuring that every client we deal with enjoys high-grade financial services for a reasonable cost.

Flexible, versatile, pro-active and responsive, we’re the virtual bookkeeper of choice for a growing number of SMEs across the country – being virtual, we are able to work on books for businesses in remote, inaccessible locations, as well as those in towns and cities. No matter where you are, what type of bookkeeping you need or the size of your business, we can work with you to help you realise your business goals.

Although we mainly work with SMEs, we have the expertise to work with almost any sort of organisation to ensure they’ve got the financial information they need for sustainable success. Get in touch to find out more about Geekbooks, or to tell us what you need.

Testimonials

Kaygus Logistics Testimonial

GeekBooks takes care of all our bookkeeping and payroll wages, giving us more time to focus on running Kaygus Logistics.

Tristan Pitt-ware

Greg – Hairhouse Salon Testimonial

Greg explains how partnering with Geekbooks delivered better reporting, easier bookkeeping, and a smarter, more efficient workflow.

Greg

Accounting Made Simple

With GeekBooks, I save valuable time and know my accounting and bookkeeping are handled with excellence. Their straightforward approach and reliability give me complete confidence that the work will be done right, on time, every time. Having that trust has helped me enormously and allows me to focus on what matters most-my clients.

Shukla & Associates

Geekbooks has helped

Thanks to the team at Geekbooks, I can now finally focus my attention on working on my business, not in my business. From managing invoices to chasing up outstanding payments, Geekbooks has helped me so much. They are friendly, easy to work with and just make it happen. Thanks guys.

Gunjan

True Professionals

I recommend Geekbooks as true professionals whom have the experience to handle any situation from the simplest bookkeeping to preparing books for accountants use or auditing. Since engaging with Geekbooks they have helped my business grow and taken the pressure off me so I have more time to run my business as I should be. I have the utmost confidence in referring clients to Geekbooks.

Gerard

Managing the Books

We have been using Geekbooks bookkeeping services since the end of 2017. They have really taken the stress out of managing the books, as no request is too small or too big. They are quick, efficient and professional and my business would not be in the position it is in now if I didn’t have them backing me every single step of the way. Weekly payroll is now a stress free day for me as all I need to do is send a report of hours worked for employees and they calculate the rest. Never been so stress and hassle free in my life since when I signed up with Geekbooks.

Prakash Automotive Services