Superannuation is an effective and reliable way for hard-working Australians to save for retirement.

In general, employers must pay into a superannuation fund for their employees.

As per Australian law, the superannuation rate is the minimum amount an employer must contribute to their employees’ superannuation funds.

What is the current superannuation rate? From July 1, 2022, the superannuation rate is 10.5% of an employee’s ordinary time earnings.

This rate is set to rise to 11% on July 1, 2023, and gradually increase to 12% by 2025.

“Ordinary time earnings” refers to the amount of money an employee earns during their usual work hours, including their salary or wages and possibly certain allowances, bonuses, and commissions.

Overtime and other non-regular payments are generally not included in ordinary time earnings.

An employer may pay a higher superannuation rate in circumstances such as these:

- An employee has a specific clause in their employment contract requiring a higher superannuation contribution.

- An employee is covered by an industrial award or agreement that sets a higher superannuation rate.

- An employee receives a higher rate as part of their benefits package.

Employers must pay the correct amount of superannuation for their employees.

Employees can check their superannuation contributions by looking at their payslip or superannuation account online.

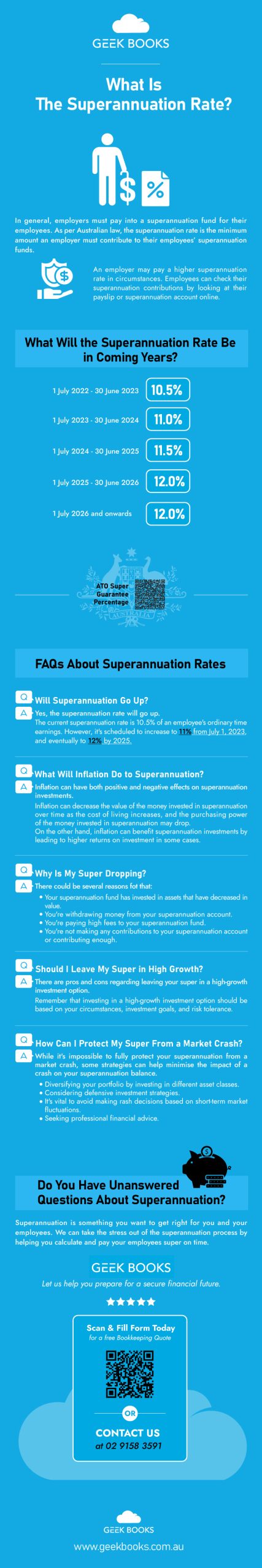

What Will the Superannuation Rate Be in Coming Years?

The Australian government sets the superannuation rate to provide people with a sufficient retirement income.

This rate is subject to change due to legislative changes and government policy decisions.

While the current superannuation rate is 10.5% of an employee’s ordinary time earnings, it has increased gradually over the years.

These increases ensure adequate retirement savings, as life expectancies have increased, meaning people are living longer in retirement.

See the table below for past, current and future superannuation rates.

| Period | Superannuation Rate |

|---|---|

| 1 July 2022 – 30 June 2023 | 10.5% |

| 1 July 2023 – 30 June 2024 | 11% |

| 1 July 2024 – 30 June 2025 | 11.5% |

| 1 July 2025 – 30 June 2026 | 12% |

| 1 July 2026 and onwards | 12% |

For more information detailing the superannuation rate in Australia, visit the Australian Taxation Office website.

FAQs About Superannuation Rates

Will Superannuation Go Up?

Yes, the superannuation rate will go up. The current superannuation rate is 10.5% of an employee’s ordinary time earnings.

However, it’s scheduled to increase to 11% from July 1, 2023, and eventually to 12% by 2025.

The government sets these increases to ensure Australians have sufficient retirement savings.

This means you’ll have more money saved for retirement, reducing your reliance on government pensions and other forms of social welfare.

What Will Inflation Do to Superannuation?

The impact of inflation on superannuation investments depends on factors including the inflation rate, your superannuation fund’s investment strategy, and the economy’s performance.

Inflation can have both positive and negative effects on superannuation investments.

Inflation can decrease the value of the money invested in superannuation over time as the cost of living increases, and the purchasing power of the money invested in superannuation may drop.

On the other hand, inflation can benefit superannuation investments by leading to higher returns on investment in some cases.

For example, inflation can result in higher interest rates, increasing the value of investments in bonds and other fixed-income securities.

Why Is My Super Dropping?

There could be several reasons why your superannuation balance is dropping.

- Your superannuation fund has invested in assets that have decreased in value. This decrease could happen due to market fluctuations, economic conditions, or other factors that affect the performance of investments.

- You’re withdrawing money from your superannuation account.

- You’re paying high fees to your superannuation fund. It’s important to review the fees your superannuation fund charges and compare them with other options to get the best deal.

- You’re not making any contributions to your superannuation account or contributing enough. Understanding contribution requirements and making additional contributions if necessary is essential to saving enough for retirement.

Should I Leave My Super in High Growth?

There are pros and cons regarding leaving your super in a high-growth investment option.

| Pros | Cons |

| Potential for higher returns over the long term. | Typically riskier than more conservative investment options, and short-term money loss is possible. |

| Suitable if retirement is a long way off for you as that allows more time for a high-growth investment option to reap benefits. | Possibly not the best choice if you’re nearing retirement, as a high-growth investment option may expose you to significant market fluctuations. |

Remember that investing in a high-growth investment option should be based on your circumstances, investment goals, and risk tolerance.

Seek professional financial advice from the GeekBooks team to help you make smart superannuation investment decisions.

How Can I Protect My Super From a Market Crash?

While it’s impossible to fully protect your superannuation from a market crash, some strategies can help minimise the impact of a crash on your superannuation balance.

One strategy is diversifying your portfolio by investing in different asset classes to help reduce your risk exposure to any one investment.

Different asset classes include

- Stocks and shares.

- Fixed-income securities, such as bonds and government debt.

- Real estate or property funds.

- Commodities, such as gold or silver.

- Alternative investments, such as private equity or hedge funds.

Another option is to consider defensive investment strategies.

These strategies focus on more conservative investments, such as bonds and cash, that can provide stability during market fluctuations.

You want to keep a long-term perspective on investing in superannuation.

Market downturns are a normal part of the investment cycle, so it’s vital to avoid making rash decisions based on short-term market fluctuations.

Seeking professional financial advice will help you make informed decisions about protecting your superannuation investments.

Do You Have Unanswered Questions About Superannuation?

So, what is the superannuation rate? It’s the minimum amount an employer must contribute to employees’ superannuation funds.

While the rate is currently 10.5% of an employee’s ordinary time earnings, it’s set to rise to 11% on July 1, 2023, and eventually 12% by 2025.

Are you a small business owner with more questions about superannuation?

Talk to the professionals at GeekBooks today for expert advice on Superannuation Accounting and Financial Services.

Superannuation is something you want to get right- for you and your employees.

We can take the stress out of the superannuation process by helping you calculate and pay your employees super on time.

Let us help you prepare for a secure financial future.

Complete our online booking form or call for a free bookkeeping quote.