Payroll software is an absolute must for a business that has employees.

It’s about much more than simply managing things like taxes and benefits; it provides employees with clear, accurate information about their wages and the relevant deductions involved.

Once upon a time, payroll software was bought and downloaded then run from the office.

Payslips would be printed out and handed to employees, who would then take them home and put somewhere safe (hopefully!)

Today, payroll systems are cloud-based and have far greater functionality.

They allow for superior redundancy and backups and facilitate digital record-keeping with payslips that employees can access remotely, saving on resources like printer ink and paper.

This digital revolution also makes things like submitting queries easier for employees, with centralised support available.

The only real question is which payroll software to work with.

You want it to run seamlessly with your accounting package, so be advised that the best payroll software often comes from the providers of the best accounting software.

What Is Payroll Software? (with examples)

If you run a business with employees, you will need to pay payroll tax.

It is a self-assessed, general-purpose state and territory tax based on wages payable/paid by an employer to its employees.

You pay it once your total wage bill exceeds a threshold amount.

As such, you need to keep track of everything to pay the correct amount of tax and provide evidence that you are doing so.

As an example of when to register for payroll tax, consider the following:

In the financial year 2018-2019, NSW and QLD had a 31-day threshold of $72,192 and $91,666 respectively.

Any business with employees in NSW or QLD with a total Australia-wide wage bill for those 31 days of:

- $75,000 – would only have to register in NSW

- $95,000 – would have to register for payroll tax in both states

If your total wage bill for all of Australia is below the maximum threshold for your territory or state, you are not required to pay.

But you can see how it can get complicated, and without professional help and/or powerful payroll software at your disposal, it can quickly become difficult to keep up.

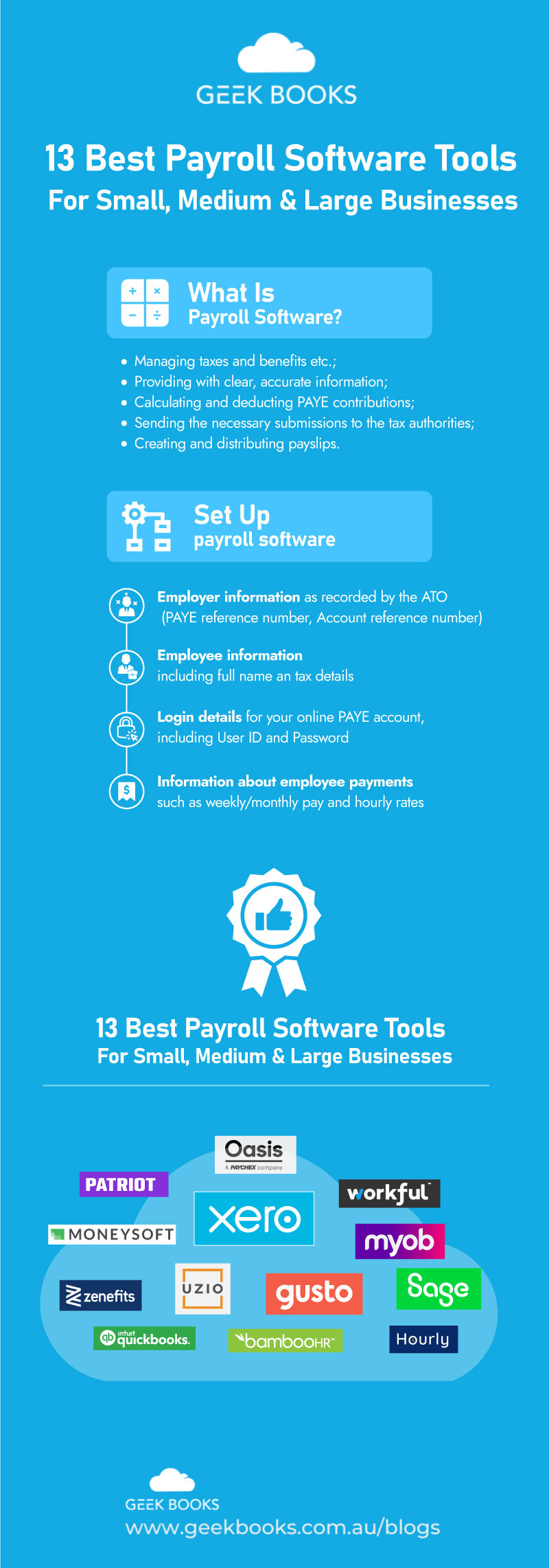

Payroll software enables, among other things, the following tasks:

- Calculating and deducting PAYE contributions for employees

- Sending the necessary submissions to the tax authorities

- Creating and distributing payslips

The only alternative to implementing payroll software is to pay someone else to do the work for you.

An accountant or a specialist payroll firm can do it, but it may be less cost-effective and they would likely be using the same software.

Failure to pay your payroll tax in a timely and accurate way can be extremely costly for your business.

Interest will be charged on unpaid amounts and legal action can be taken against anyone who doesn’t work with the Australian Tax Office to address the problems.

What do I need to do to use payroll software?

In order to implement and run your payroll, your software will need to be set up with the following information:

- Employer information as recorded by the ATO (PAYE reference number, Account reference number)

- Employee information including full name an tax details

- Login details for your online PAYE account, including User ID and Password

- Information about employee payments, such as weekly/monthly pay and hourly rates

This means you will need to set up a PAYE account when you register yourself as an employer.

13 Best Payroll Software Tools for Small, Medium & Large Businesses

Here is the list of the best payroll software platforms available to use right now.

We’ve included a little background on each one, and some details about who they are designed for and what features they have, as well as pricing.

1. Xero

Xero is headquartered in New Zealand, where it was founded in 2006.

It is a popular cloud-based accounting solution and Xero Payroll automatically updates your accounts and creates ATO submissions in addition to managing the payroll tasks you have to do.

Its integration with the Xero accounting software means it works seamlessly with your accounts solution for a comprehensive package for managing your business accounts affairs.

Best for small and medium businesses

Xero is a scalable solution and, with some creative use of its features and functions, can be adapted for fairly large organisations, capped at 200 employees.

It is easy to make adjustments, and it simplifies the processes of tracking employee times and leave, processing pay and pensions and reporting the correct information to ATO.

Features

- Automatic tax and leave calculations and accounts updated simultaneously

- Simple RTI submissions to ATO

- Accessible from any device with superb security

- Customisable to make it perfect for your business

- Allows employees to use the app to provide their timesheets or request leave

- Extensive support in Central available 24/7 for subscribers

Pricing

There is a 30-day free trial available.

If you take out a Business Edition Plan, it is free for the first 3 months.

After this, it is $10 for up to 4 payroll employees per month, and an additional $2 for every other employee up to a maximum of 200.

This pricing is current as of 2022.

2. Oasis

Oasis provides a comprehensive range of HR solutions for business, covering the entire employee lifecycle (including payroll).

It includes features for everything from recruitment to onboarding as well as payroll and training, with regulatory compliance features built-in.

It incorporates self-service computer software for employee management alongside personalised support. It also comes with Fortune 500 benefits.

Best for small and medium businesses

Oasis offers what you expect from a payroll solution but with more personalised support for its HR and payroll capabilities.

Features

- Automatic calculation and filing of payroll taxes

- Simple management of employee benefits

- Superb accessibility via the online portal or the Oasis app

- Support is second-to-none

- Easy to use with access to employee records, payroll and compliance updates

Pricing

Oasis is quote-based, tailored to your business.

Charges can be based on a percentage of total payroll or a per-cheque, per-employee fee.

You will get a free quote by providing a few key details to Oasis and selecting the type of plan you want.

There is no free trial option.

3. MYOB

MYOB is an online accounting software designed with small and growing businesses in mind to help wit core accounting and payroll processes.

It is only available to users in Australia and New Zealand and it helps avoid the mountains of paperwork that come with not using a PAYE software solution.

You will be able to create professional-looking quotes and invoices, as well as automated invoice reminders and notifications when a customer opens an invoice.

One key feature is its Single Touch Payroll feature, meaning it automatically reports employees’ payroll and tax information to ATO whenever an employee is paid through MYOB.

Best for small and medium businesses

MYOB is specifically designed with smaller and growing businesses in mind, including freelancers.

Features

- Single Touch Payroll-enabled

- Automatic tax and superannuation calculation

- Mobile timesheet and payslip management

- Create dozens of reports

- Drill down with custom date ranges

Pricing

MYOB comes with a number of pricing plans.

The payroll-only plan is a mere $10 per month, or you can choose the Business Lite or Pro plans for $12.month or $25/month respectively.

You can include the AccountRight Plus plan for $60.month or AccountRight Premier for $75/month, so choose the plan that is right for you.

There is no free trial available.

4. Sage Business Cloud Payroll

Sage Business Cloud Payroll claims that half of all businesses use their platform.

That means that when you come on board, you join a very sizable club that consists of many start-ups and household names.

The platform has dedicated payroll solutions for businesses that have fewer than 25 employees and those that have more than 25, so it is a versatile solution.

Best for small and medium businesses

Sage Payroll is ideal for smaller businesses with the packages it offers, but it can be scaled up to work for much larger organisations as well.

Features

- Can function as a standalone solution or integrate with Sage accounting

- Print/email payslips, reports and P60s

- Simple amendment of previous pay runs, with automatic adjustment handling

- Integrate seamlessly with pension providers

- Web-based and highly intuitive

Pricing

Sage comes with an initial 3-month free trial period.

After that, you will pay $14 + VAT per month for up to 5 employees, $24 + VAT for up to 10, $34 + VAT for up to 15 and $54 + VAT for up to 25.

These prices are subject to change.

5. QuickBooks

Quickbooks is a hugely popular solution used by millions of small businesses all around the world.

The Quickbooks payroll add-on offers a range of smart payroll features to make those tasks simpler, freeing you up to focus on actually operating your business.

Whether you need to organise payslips, pensions or statutory pay, or make real-time submissions to ATO from the office or on the go, Quickbooks makes it happen with comprehensive automation features and intuitive interfaces.

Best for small and medium businesses

Quickbooks is specifically designed for small and growing businesses who need help managing their payroll obligations.

Features

- Easy to use on Windows or Mac, with a free app for mobile devices

- Make multiple pay schedules

- Handle statutory maternity/paternity/sick leave payments

- Net pay, taxes, etc. all calculated automatically

- Print/email payslips

Pricing

Payroll is an add-on to Quickbooks.

You can get the standard version for $8 per month + $2 per paid employee.

There is a more advanced solution available for $16 per month + $2 per paid employee per month.

This is in addition to a QuickBooks subscription ($10-$24 per month for a 6-month subscription).

6. Patriot Payroll

Patriot Payroll is excellent for businesses with fewer than 100 employees whose operations are exclusively within Australia as it does not facilitate international payment.

It is a very good payroll solution, but falls short with broader personnel administration as it lacks more comprehensive HR features.

It is a low-cost solution with excellent tax filing perks and superb customer service.

Best for small and medium businesses

Patriot Payroll is ideal for businesses with fewer than 100 employees – particularly those that are budget-conscious and don’t require more fully-featured HR software.

Features

- Excellent accounting solution

- Unlimited payroll runs

- Automated filing of tax forms

- AI-powered task completion

- Low costs with excellent customer support

Pricing

Patriot Payroll is an affordable solution for smaller businesses in need of a straightforward payroll system.

The basic version costs $10 per month plus an additional $4 per employee per month.

You can get more fully-featured versions for a slightly higher price.

7. BambooHR

BambooHR is a human resources solution with its own payroll functions built-in.

It incorporates everything you could need from a payroll solution, including adding new employees quickly, tracking hours and bonus payouts and automated tax calculations.

The integration with HR features will be very useful for some, particularly growing businesses with more employees to keep track of.

Best for small and medium businesses

BambooHR offers its payroll solution alongside a high-quality HR suite that makes it superb for medium-sized organisations.

Features

- Integration with high-quality HR platform

- Time-off tracking

- Applicant tracking for recruiting and onboarding

- Detailed staff database/records

- Easily track employee hours and bonus payouts

Pricing

There are two tiers of subscription offered with BambooHR: The Essentials plan and the Advantage plan.

There are lots more features with the second option, but the pricing is opaque with the company.

You must get in touch with them to receive a quote.

8. Hourly

Hourly allows you to cut through all the paperwork with automation features for both time tracking and payroll tasks.

This makes it an invaluable tool for small businesses without a dedicated payroll department.

It is contractor-friendly and richly featured, and you can get it in combo packages for added value. It combines payroll and time management features to enable business users to save time and money through greater efficiency.

Best for small and medium businesses

The features of Hourly make it perfect for small businesses needing to cut down on the time spent on payroll.

Depending on which package you choose, you get a range of features to improve efficiency in every aspect of your company’s payroll.

Features

- Time Tracking enables you to track time for all workers with automatic timesheets and GPS clock-ins

- Manage salaried and hourly payments plus benefits and bonuses

- Excellent support

- Mobile capability – use it on the go

- User-friendly interface for ease of use and greater efficiency

Pricing

You can use Hourly on a 14-day free trial without entering any credit card information.

The Time Tracking suite has a base fee of $40 per month, and an additional $8 per active user. Payroll costs $60 per month and $10 per active user.

You can save 20% when you subscribe to both for $80/month plus $14/month per active user.

9. Workful

Workful is an excellent solution for small business owners with its ability to cover payroll, HR and timesheets in a single package.

It is user-friendly and easy to set up, with attractive pricing and very versatile features.

Users get an employee portal for a range of things, with brilliant time tracking including overtime and automatic calculations.

With great employee tools and easy onboarding, it really is a great way to ease the burden of payroll and HR.

Best for small businesses

Workful is aimed at small businesses that need to focus on their core activities rather than losing time maintaining payroll records.

Features

- Multiple pay rates

- Unlimited payroll runs

- Built-in time tracking

- Tax forms and reporting

- Easy integration with QuickBooks

Pricing

There is no free plan for Workful but it does offer a free trial.

The pricing starts at 25 USD per month, plus 5 USD per month per employee.

10. Uzio HR and Payroll

Uzio HR and Payroll allows you to streamline a number of business admin tasks in a singe online platform.

It is richly-featured with powerful tools covering everything from HR to tax considerations, as well as record management, compliance and comprehensive payroll duties.

Tailor your package to meet your needs with scalable solutions and enjoy plenty of automation features to enable you to focus on running your business.

Best for small to medium businesses

Uzio is a scalable solution with versatile packages that you tailor to your needs, so it can work for small businesses and medium-sized, growing ones.

Features

- Cloud-based solution that integrates payroll with HR

- Manage salaries, taxes and year-end reporting within the same application

- Onboarding new employees

- High-quality time-tracking features

- Intuitive dashboards and controls for ease of use

Pricing

Payroll packages are specifically designed for your business, so pricing can vary.

Payroll starts at $30 USD per month + $4.50 USD per employee.

There is a 30-day free trial available and Uzio will work with you to construct your package and provide a quote.

11. Zenefits HR and payroll

Zenefits HR and Payroll offers a comprehensive cloud-based package for small businesses to manage their staff and payroll.

There are three different packages available, and you must have a minimum of 5 employees.

One particular feature that might appeal is the Wellbeing tools it offers in the Zen package, adding employee welfare to the usual suite of tools like admin, onboarding, tracking, salary, etc.

Best for small businesses

Zenefits is primarily aimed at small businesses employing 5+ people, but its rich features can be useful for growing businesses as well.

Features

- Core HR integrated with time and scheduling and a high-quality mobile app

- Wellbeing tools to monitor the wellness of your employees alongside core admin tasks

- HR data can be applied to payroll

- Features for onboarding and performance reviews

- Comprehensive reporting tools plus tax and filing assistance

Pricing

Zenefits pricing is presented in USD.

The Essentials package costs $8/month per employee, while the Growth package costs $14/month per employee.

The Zen package is $21/month per employee.

The payroll add-on costs $6/month per employee and can be integrated with any of the packages.

12. MoneySoft Payroll Manager

MoneySoft Payroll Manager is a comprehensive, intuitive payroll solution that is recognised by ATO and offers full compliance features.

It is used by thousands of SMEs as well as agents, accountants and CIS contractors.

It is created and managed by UK-based company MoneySoft and offers a range of benefits for business users and excellent email support.

Best for small businesses

MoneySoft Payroll manager is best for small businesses, and can be used for multiple businesses in a single package.

Features

- Fully compliant payroll software

- User-friendly with simplified data entry

- Tax filing, reporting and automated calculations for superb efficiency

- Always updated with current legislation

- Cost-effective and versatile with free trial available

Pricing

The Payroll manager costs $144 + VAT per year for one company, or $288 + VAT per year for a multi-company license.

There are no additional or hidden costs, and it is offered as a desktop-only solution.

13. Gusto

Gusto is a full-service payroll solution with time-tracking, compliance and tax management features.

It also covers benefits and pension considerations for all employees and can be integrated with other accounting software like Quickbooks or Xero.

It can be used with a handful of different plan levels to gain access to the features you need.

The full-service payroll solution is richly featured.

Best for small to medium businesses

Gusto works for businesses of all sizes thanks to its diverse features and easy integration with other accountings software.

Features

- Employee self-service offerings

- Useful onboarding features

- Directories and surveys

- Excellent support offerings and large resource centre

- Time-tracking, compliance, tax management and benefits with rich automation

Pricing

Packages start at 39 USD per month plus 6 USD per month per person.

There are more expensive subscription options with more features, so select the package that works best for your needs.

Payroll Software FAQs

What is the most popular payroll software?

The most popular payroll software solutions are Xero, Gusto, Quickbooks and Sage.

It is important for you to select the solution that meets your needs.

Which is the best payroll management software?

This really depends on your needs. The ones in this article all have rich, powerful features, but are better suited to differing needs. Compare and contrast to find what will work best for you.

What is the best HR and payroll software?

Several of the solutions in this article integrate HR and payroll. They all have their pros and cons so it is important to explore them in depth to find which has the best features for you.

What is the cheapest way to do payroll?

Though you don’t have to pay any subscriptions or service fees by doing payroll yourself, it could cost more in lost time spent on the business and fines associated with errors. Using a payroll solution makes everything much quicker and minimises the risk of errors, and they come at very affordable prices.

Can I do payroll myself?

You can, but there is lots to consider and it may be difficult if you are not an expert. It gets more complicated with more employees, and the expertise of an accountant and/or the powerful features of payroll software are strongly recommended.

What is the best way to do payroll?

The most recommended method is to use payroll software and have a professional accountant help with end of year reporting to ensure complete accuracy and full compliance.

Summary

Payroll software comes in many shapes and sizes, with different solutions optimised for different sizes of business.

Many offer different tiers suited to different sizes of company, but the more employees you have, the more complex your payroll becomes.

With the affordability of payroll software and the richness of their features, it is not recommended to run a business that employs people without one of these solutions at play.

Geek Books are Xero advisor certified and can help with integrating this powerful solution into your business and managing everything relating to payroll in the future.

If you would like personalised advice or you have any questions about our service, please don’t hesitate to contact us and speak to one of our friendly team.