Keeping your finances in check is critical for any business.

You don’t want to be left scrabbling for receipts or digging out invoices when tax season rolls around.

Whether you’re a big fan of the odd spreadsheet or you’re not so tech-savvy when it comes to your finances, keeping on top of your money is a must for any business to stay afloat.

What is bookkeeping?

Bookkeeping is a process that you use as a business to keep track of all your financial comings and goings.

In essence, bookkeeping is the recording and tracking of what goes into your business and what comes out, giving you an accurate overview of your business finances. You can find out more about bookkeeping for beginners to get an overview of the basics.

But what is the bookkeeping definition in more detail?

A bookkeeper is a person responsible for recording, managing and providing financial information for a business.

If you want some bookkeeping examples, everyday tasks for this role include reconciling finances with banks, creating monthly reports, and balancing the books by entering financial information clearly and accurately.

What is bookkeeping in accounting? Bookkeeping is a part of the broader accounting umbrella, but a dedicated bookkeeper will not provide the same breadth of services as an accountant might. Check out our bookkeeping vs accounting run-down for a better understanding of how bookkeeping is distinct from more general accounting.

To be a bookkeeper in Australia, you must be registered with the Tax Practitioners Board as a BAS Agent.

To achieve that position, you’ll need to complete a relevant qualification, such as a Certificate IV in Accounting and Bookkeeping or a Diploma in Accounting at a qualified institution.

Businesses of all shapes and sizes, from one-person startups to multinational companies, need to use bookkeeping services or employ bookkeepers to ensure their finances are up-to-date, accurate and regularly maintained by the end of the tax year.

You may be wondering, what is bookkeeping for a small business, and how does it differ?

One of the main differences between bookkeeping in small companies and startups is that the person managing the finance tends to wear more than one hat.

This could mean the business owner or the sole HR professional. In other cases, small businesses may outsource their bookkeeping to a qualified expert service.

What does a bookkeeper do?

A bookkeeper handles a wide range of responsibilities as part of their job role.

The exact requirements and obligations they will need to cover will vary depending on their position or the service they would like to offer.

Here are some bookkeeping examples that cover the services a bookkeeper can offer:

Record all financial transactions in and out of business accounts.

One of the fundamental jobs a bookkeeper does is to ensure a proper record of all the money that goes into business accounts and all the money that goes out.

Every payment a business makes and every bit of income they receive should be appropriately registered on the books for use during tax season.

Produce monthly reports

Monthly reports offer a snapshot of the current state of business finances.

This is integral to other business operations and planning, allowing owners and managers to see at a glance how well their company is doing month-on-month.

Reconcile bank accounts

Reconciliation ensures that what is written down in your books lines up with what is happening in your business accounts.

Regular reconciliation ensures your business finances aren’t out of balance and that all reporting is 100% accurate all the time.

Handle accounts receivable

Accounts receivable often also include credit control and refer to the process of creating and sending invoices for payment from other individuals or businesses.

Bookkeepers may also chase for invoices to ensure they are paid on time.

This helps to keep cash flow running for businesses of all shapes and sizes with few delays.

Handle accounts repayable

A bookkeeper can also ensure invoices that a business receives for payment are accurate and paid on time.

This allows business owners and managers to maintain excellent relationships with suppliers and other companies with a smooth, easy payment process.

Ensure you meet tax compliance requirements

Taxes are a crucial concern for any business, and bookkeepers are most busy at this time of year ensuring their clients meet all compliance requirements and submit the necessary tax paperwork for you.

This can prevent late fees and provide accurate reporting for taxes with no additional last-minute work required.

Manage payroll and HR functionality

Depending on the specific bookkeeper, their services may cover certain areas of payroll and HR.

This could include handling expenses, paying salaries, and ensuring all payments are 100% accurate each month. Reducing the need for additional staff and input to handle monthly payroll.

Provide guidance on the best accounting technology and workflows

A trained and qualified bookkeeper has insight into the best software and technology on the market to streamline your business operations.

They may be able to advise on business planning and reduce time spent on taxes and day-to-day finances.

Why is bookkeeping important?

Bookkeeping is vital to businesses because money is important to businesses.

Our complete bookkeeping guide goes through just why it is so important.

Keeping your finances balanced and knowing precisely what is going on with how much money is going in and out of your company is vitally important to continued operations.

Without a good idea of your finances, you won’t be able to file taxes effectively, carry out accurate business planning, or ensure your staff are paid on time.

A qualified bookkeeper can help streamline your processes and save you both time and money.

Having the proper support is especially vital for growing businesses or companies with little experience handling business taxes and payroll.

Bookkeepers provide valuable information and insight into finances that are needed to help make critical business decisions.

A bookkeeper is important to all businesses.

Their invaluable services ensure you’re meeting your tax requirements, complying with your responsibilities as a business and staying on track for your plans and growth.

Whether you’re looking for simple bookkeeping to keep track of your finances or payroll and HR services, a bookkeeper is a vital addition to any team.

6 common bookkeeping questions (answered!)

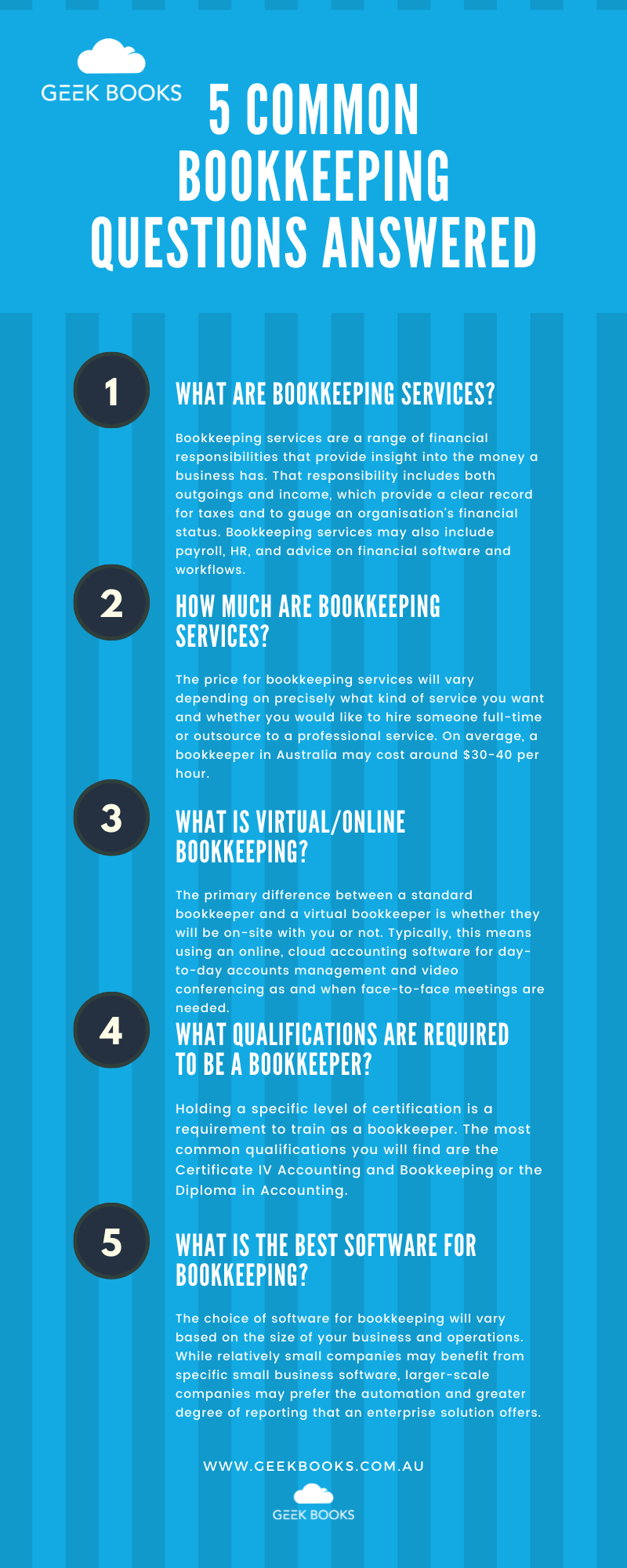

1. What are bookkeeping services?

Bookkeeping services are a range of financial responsibilities that provide insight into the money a business has.

That responsibility includes both outgoings and income, which provide a clear record of taxes and gauge an organisation’s financial status.

Bookkeeping services may also include payroll, HR, and advice on financial software and workflows.

2. How much are bookkeeping services?

Now that you have an idea of what bookkeeping services involve, you’re probably asking yourself how much does a bookkeeper cost? The price for bookkeeping services will vary depending on precisely what kind of service you want and whether you would like to hire someone full-time or outsource to a professional service.

On average, a bookkeeper in Australia may cost around $30-40 per hour.

However, this depends on the exact service you need.

If you only require basic bookkeeping and tax preparation, this cost may be entirely different to a bookkeeper that provides weekly reporting, and ongoing payroll and handles your day-to-day accounts receivable and repayable.

The best option is to get a quote for the specific services you require.

3. What is virtual bookkeeping?

Virtual bookkeeping is the same as an in-person professional bookkeeping service.

If you know the answer to ‘what is bookkeeping?’, you have all the details on what a virtual bookkeeper can offer.

The primary difference between a standard bookkeeper and a virtual bookkeeper is whether they will be on-site with you or not.

With many businesses taking the remote route for their employees, it’s easier than ever to hire specialised bookkeepers to work virtually for your business.

Typically, this means using online and cloud accounting software for day-to-day account management and video conferencing as and when face-to-face meetings are needed.

4. What is online bookkeeping?

With the majority of bookkeepers using standardised cloud software and technology to do their jobs, online bookkeeping is the modern standard for the industry.

Online and virtual bookkeeping are interchangeable terms and refer, for the most part, to remote, online services that allow bookkeepers to support your business from a distance.

5. What qualifications are required to be a bookkeeper?

Holding a specific level of certification is a requirement to train as a bookkeeper.

The most common qualifications you will find are the Certificate IV Accounting and Bookkeeping or the Diploma in Accounting.

Online bookkeeping also makes it easier than ever to look up reviews and information on potential bookkeepers, allowing businesses to choose someone qualified for the job.

It’s important to hire a trained professional to carry out any jobs relating to finance, ensuring your accounts are balanced and reporting is accurate year-round.

Picking a reputable, trained, and experienced bookkeeper is always the best choice for any company.

6. What is the best software for bookkeeping?

The choice of software for bookkeeping will vary based on the size of your business and operations. Check out our guide to some of the best bookkeeping templates and accounts spreadsheets to help your business.

While relatively small companies may benefit from specific small business software, larger-scale companies may prefer the automation and greater degree of reporting that an enterprise solution offers.

Often, bookkeepers may have a preference for the specific software they use, as well as extensive experience in making it work for your business.

If you don’t already have a system in place, hiring a professional bookkeeper who can advise on the right software and technology can benefit any business.

Summary

Do you have further questions along the lines of ‘what is bookkeeping?’ We’ve got you covered.

As qualified and professional bookkeepers, our team at Geekbooks is here to help every step of the way. Take a look at some bookkeeping tips from the experts, and speak to us today to get started.