It can be a challenge for many start-up businesses to juggle all the hats you have to wear. From payroll to operations, management to sales.

Keeping on-track with every element of your business can be a struggle even for the most accomplished of individuals. One way to relieve the pressure and keep your company on an even keel from the start is to look at accounting for start-ups.

While start-up accounting services may be something you haven’t thought about before, leaving your start-up accounting in the hands of an expert might be the best thing for you.

Even better for your business, leaving you time to spare for other, essential business matters. What is start-up accounting? How do you find the right start-up accounting firm, and how do you get the ball rolling?

Our complete guide covers all you need to know about finding accounting services for start-ups that suit your business needs. From what a start-up business accountant is to how they can help you, we cover it all to ensure your business can get the help it needs. Read on now to get started:

What is accounting for start-ups?

The needs and requirements for the average start-up business can change rapidly. From sudden growth to quieter periods, start-up accounting ensures you’re always up-to-date on your financial requirements and obligations such as BAS preparations as a business.

No matter how busy you get or how quickly you grow, a start-up accountant can help your business. Taking necessary financial requirements off your plate, and ensuring you have the expert knowledge needed to navigate the business world.

Whether you’re brand-new to owning your own business, or you’ve owned start-ups in the past, an accountant for start-ups is a valuable way to outsource critical responsibilities.

Functions and processes that your business needs to run smoothly meet deadlines, and stay within your budget. From payroll to bookkeeping to general accountancy and advice, using an accounting start-ups service is the best way to ensure your start-up has long-term financial success.

How does a start-up accountant differ from a normal accountant?

Larger-scale businesses and organisations often handle their accountancy in-house with a dedicated finance department.

But even if they outsource to a qualified accountancy service, their requirements may be entirely different from your needs as a start-up.

A start-up accountant is someone that has a full understanding of your requirements, goals, and limits as a small business.

By choosing to work with an accountant that understands small business finance, you’re in a far better place to achieve success.

This is especially true when everything financial is handled by a single person, including payroll, taxes, and any other budgetary and financial requirements your start-up might have.

While a larger company accountant may specialise in a specific area of accountancy, start-up accountant services cover the whole spectrum with their unique expertise and insight.

Why do you need an accountant for your start-up?

Why might you use an accountant for start-ups? The primary reason that any small business outsources their accountancy is that they don’t have the capacity or expertise in-house.

Hiring a dedicated financial expert can be costly. For small companies, it doesn’t work as part of the budget. Instead, outsourcing to a specialise start-up accounting firm can provide that level of expertise, without the cost of hiring someone specifically for the role.

Many start-up owners start out handling finances themselves. But as their team grows and their business expands, there is no longer the time or bandwidth to handle everything themselves.

That’s where an external start-up accountant comes in handy. Not only does hiring an accountant relieve the pressure, but it can be a near-immediate transition – allowing finances to be handled effectively and professionally without an awkward cross-over period.

What kinds of things can accounting start-ups services do?

Accounting services designed explicitly for start-ups tend to mimic the ways start-ups do things in-house. An individual accountant covers most areas of finance.

This means the different regions of accountancy are all covered in one personal service, with no need to look elsewhere. For the average start-up, everything you do in-house financially could be handed off to an expert professional.

What specific things do start-up accountants do? That varies depending on the size of the start-up, their financial obligations, and the degree of the support they need. But in general, all the following could be covered by a professional start-up accountancy service:

• Bookkeeping

• Payroll

• Taxes

• BAS Preparation

• Superannuation

• Bank Reconciliation

• Reporting

• Invoice Management

• Debtor Management

What do I need to get started with a start-up business accountant?

If you’re considering starting to us a start-up accountant service for your small business, you’ll need to do a little work up-front to make sure you’re prepared to hand everything over.

In practically any case, it will be recommended that you open a separate business bank account before starting with an accountancy firm, if you haven’t done so already. It will also help if you have a clear idea of your future goals, the ways you want to grow, and how this may affect your finances.

Technically, if you’re moving from an in-house accountancy system to an outsourced one, a smooth transition is entirely possible.

Especially if you’re 100% up to date and organised when that transition occurs. But for many start-ups, growth can mean certain things fall through the cracks – including an organised record of finances.

In that case, you may have to work back through the current year’s finances with an accountant to start with that all-important fresh slate.

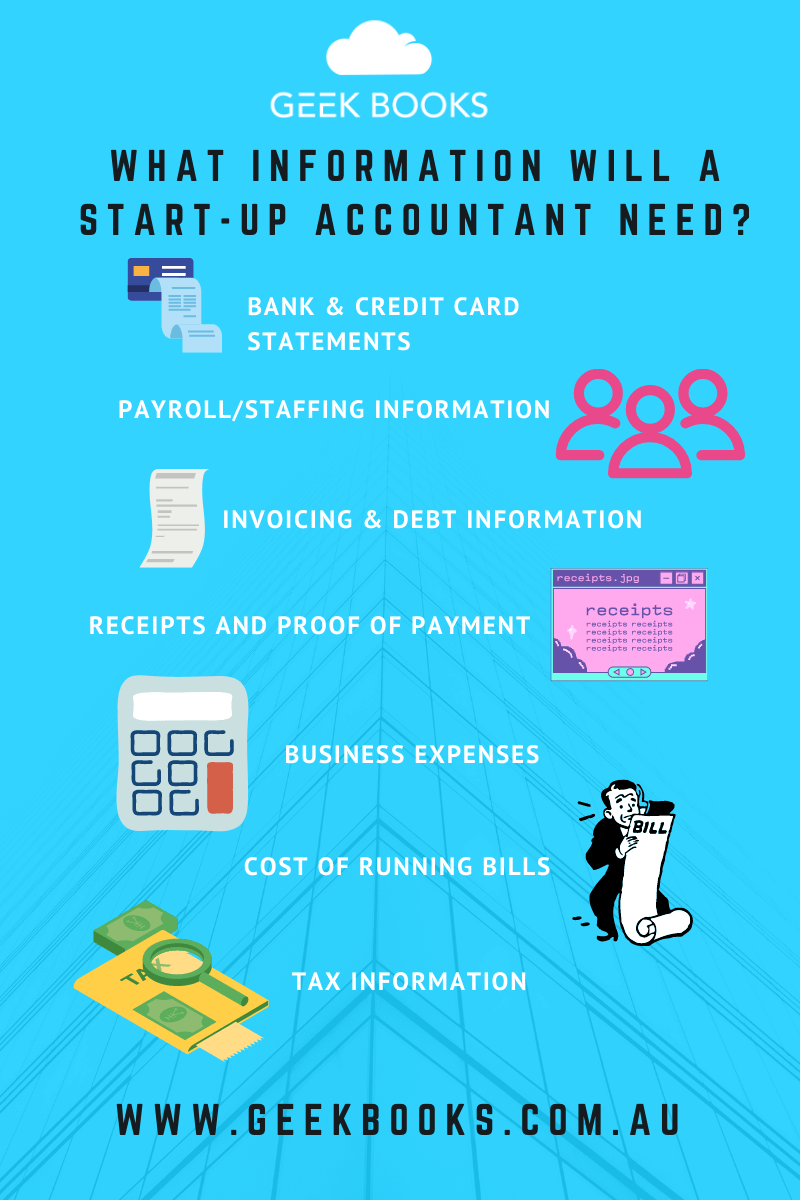

What information will a start-up accountant need?

Once you’ve agreed to work with a start-up accountancy service, the next thing you’ll need to do is provide what the accountant needs to complete your financial responsibilities.

Depending on the nature of your business – for example, if you’re selling products, services or something else entirely – the paperwork you’ll need to provide may be altogether different.

As a rule, here are some of the things you may need to provide to your start-up accountant to ensure they can do their job correctly. Keeping your finances clean, organised, and ready to go:

• Bank & Credit Card Statements

• Payroll/Staffing Information

• Invoices

• Receipts and Proof of Payment

• Business Expenses

• Cost of Running Bills

• Tax Information

• Any Financial Statements

• Debt Information

While what you need to provide will vary depending on both your business and the service you choose, these are just some of the things you may need to provide. In most cases, it can be as simple as forwarding digital copies to your accountant – making it easy to stay up-to-date and on-track.

Which start-up accountant is the best for my business?

If you’re considering the best start-up accountancy service for your business, Geekbooks might be what you’re after.

With extensive experience in supporting start-ups across various industries, our professional team is well-equipped to handle every aspect of your finances.

From payroll to bookkeeping to debtor management, our reliable and professional approach is the perfect fit for your start-up.

Get started with Geekbooks today

Ready to try out Geekbooks? Get in touch with our team today to find out more about our accountancy start-up services, or take a look at our services page to discover all the things we could do for you.