If you run a business, how to calculate payroll taxes is a key skill to have. Even if you have no employees, you will still need to calculate how much payroll tax you’ll have to pay as an individual.

Here we take an in-depth look at payroll tax, including information on what it is, different methods of calculating payroll taxes and how feasible it is to manage your payroll tax calculations in-house.

Geekbooks are an experienced team of professionals who offer a complete suite of online business bookkeeping services. With particular expertise in helping smaller enterprises, Geekbooks are available to answer all your queries regarding how to calculate payroll tax, as well as on hand to do the job for you if required.

What is Payroll Tax?

The term “payroll tax” is probably a bit of a misnomer, as there are actually a number of different taxes bundled beneath the payroll tax banner. At its most basic, the payroll tax is the sum of all the taxes which an employer needs to pay on behalf of an employee, and which the employer needs to withhold from the employee’s salary or wage to pay to ATO.

The amount and type of payroll tax components vary between states. In general, payroll tax comprises the following:

Employee taxes

– Income tax

– Contribution to Medicare and superannuation

Employer taxes (that need to be paid on behalf of each employee)

– Contribution to each employee’s Medicare and superannuation payment

When considering how to calculate employer payroll taxes, it’s important to be aware of current rates for each of the required deductions. Rates can (and do) change over time; reporting arrangements can also change. We recommend checking the ATO site for any updates or proposed changes prior to calculating payroll information, in order to make sure you’re 100% up-to-date.

Setting up your payroll and the payroll process

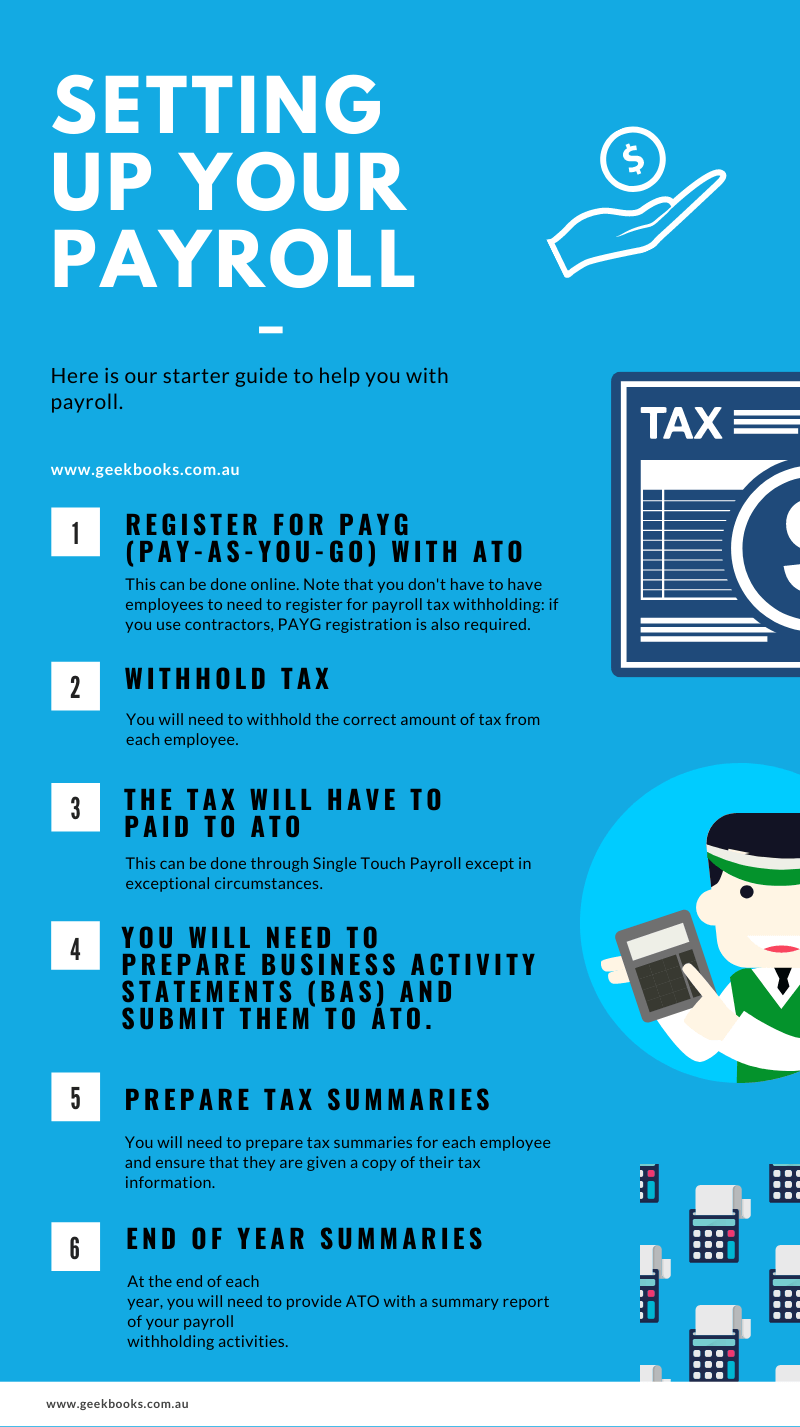

Before beginning to pay employees, there are a number steps that employers need to take to ensure they are “payroll ready”. These are:

1. Register for PAYG (Pay-As-You-Go) payroll tax withholding with ATO. This can be done online. Note that you don’t have to have employees to need to register for payroll tax withholding: if you use contractors, PAYG registration is also required.

2. You will need to withhold the correct amount of tax from each employee.

3. The tax will have to paid to ATO (through Single Touch Payroll except in exceptional circumstances).

4. You will need to prepare Business Activity Statements (BAS) and submit them to ATO.

5. You will need to prepare tax summaries for each employee and ensure that they are given a copy of their tax information.

6. At the end of each year, you will need to provide ATO with a summary report of your payroll withholding activities.

What Employee Information is Needed to Calculate Payroll Tax?

Before commencing a payroll calculation, you will need to have the following information about each employee in your organisation to hand:

– Is the employee an employee or a contractor? This sounds paradoxical, but if you are outsourcing work to outside contractors, or consultants, you need to check whether they meet the criteria to be classed as independent workers, or whether they are actually employees.

This is an important distinction to make for tax reasons. If you’re not sure, we strongly recommend professional assistance, in order to avoid ATO difficulties further down the line.

– Date employment commenced and/or ended.

– Contact information: name; address; date of birth.

– Tax file number

– Bank account details

– Pay details (including how much has already been paid in the current year, hourly or monthly rate)

– Details of any expenses that will need to be deducted from wages.

Remember to ensure employee records are up-to-date so that their payroll tax rates are in line with their personal circumstances.

Setting up Single Touch Payroll

STP (Single Touch Payroll) has been in operation for a number of years now.

Intended to simplify the reporting of payroll tax information, STP uses software that links with your payroll software.

When details of an employee’s payroll deductions are inputted into your payroll software, the information is automatically sent off to ATO, every time the employee is paid.

Once STP is in place, ATO has an accurate record of payroll tax contributions. This makes it easier to spot any errors early on, before they have had a chance to snowball.

Although STP can save a considerable amount of time, it does require an enterprise to have payroll software in place, or to use a payroll professional who inputs your payment data into suitable software.

Note that micro-businesses (those with four or fewer employees), can still calculate their payroll tax manually, but will then need to use a software-enabled agent to pass the information on to ATO.

This only applies until June 2021, after which ATO currently expects businesses to be able to use STP.

If you are concerned about your ability to use STP, or lack the technical resources to use it, a professional bookkeeper could provide the perfect solution.

Reconcile your payroll and bank account

Your payroll software will perform the withholding calculations automatically once the correct information is inputted.

That on its own is insufficient to ensure that the amount you’re paying out is accurate.

There is a need to reconcile your payroll withholding amounts against your bank account, and also with the past and (predicted) future payroll withholding totals for each employee.

(i) Bank account reconciliation

– Make sure that the amount you’ve paid out as wages to date from your bank account matches the amount showing on your payroll software.

– Check that the liabilities you have for payroll withheld monies tallies with the amount of PAYG yet to be paid to ATO.

– Reconcile superannuation payments.

(ii) Reconcile payroll withholding (PAYG)

Check that the amount of PAYG that’s been withheld from employees tallies with the amount of tax that’s been paid (or will be paid) to ATO.

Create regular financial reports

Every time a pay run is completed, it’s important to print off a report, showing how much has been paid year to date, to who. When using bookkeeping software, this is usually called “a payroll payment register summary YTD report”.

You will also need to ensure that every employee is given a wage slip, detailing their gross pay, amount of payroll that has been withheld (both this period and YTD), and superannuation details.

Note that all this can be done manually, but we really recommend using appropriate software, as it makes the payroll process much faster and easier.

Calculating Payroll FAQs

How do I calculate payroll taxes?

There are many steps involved in calculating payroll taxes. Once you have calculated your gross pay, you need to calculate the Superannuation and Medicare taxes. This is done by multiplying the gross pay by the following rates: 10% for superannuation, 2% for Medicare and, if applicable, any income tax withheld from your paycheque.

What percentage of paycheque is payroll tax?

Payroll tax refers to the taxes that employers are liable for paying. The percentage of the paycheque that is payroll tax varies from country to country and is a topic of debate.

As an example, in Queensland Australia, the payroll tax rate is:

4.75% for employers that pay $6.5 million (or less) in taxable wages.

4.95% for employers that pay more than $6.5 million in taxable wages.

Payroll Tax Thresholds and tax rates vary between Australian States and Territories.

How are payroll taxes calculated for small business?

The primary difference between smaller businesses and larger organizations is that the latter has a centralised payroll department to calculate payroll taxes. Smaller businesses, on the other hand, do not have a dedicated payroll staff. As a result, they rely on third-party software or payroll service providers like Geekbooks to calculate their taxes.

Third-party software or a payroll service provider, such as Geekbooks, will calculate all of your employee’s earnings and deductions, as well as federal and state income tax withholdings. They will then submit those taxes each quarter to the ATO for you, ensuring you are best prepared for EOFY.

How do I manually calculate payroll?

When calculating payroll manually, you need to do the following:

– Add up the gross wages/monthly salaries for all employees

– Add up payroll taxes and deductions

– Take into account any overtime, bonuses, or other miscellaneous earnings

– Calculate the net pay/wage by subtracting from gross earnings

How do you calculate monthly payroll?

Monthly payroll calculations are made based on an individual’s current pay, deductions, amount of hours worked, and their pay period.

The company will need to know the employee’s gross monthly salary, the hours they worked per month, their overtime pay rate if they work over eight hours in a day or 40 hours a week, and total deductions from their paycheque.

The company then multiplies the gross monthly salary by the number of hours the employee has worked. The company needs to take into account whether or not they’ve been paid for overtime work and what that was paid at. If there are any deductions from the paycheque such as super contributions or health insurance premiums then those should be subtracted from this figure before it is multiplied by the total number of hours worked.

How do you calculate payroll hours and minutes manually?

Calculating payroll hours and minutes manually is a tedious task that requires the use of both calculators and a calculator.

To calculate the number of hours worked, you need to multiply the number of hours worked by the number of pay periods in a year (usually 52).

To calculate the number of minutes worked, you divide the number of hours worked by 40.

How do you calculate minutes for payroll?

A person’s wages, hours worked, and deductions are added up to calculate the number of minutes they should be paid for.

A person’s wages are multiplied by their hourly rate to find the total amount they should be paid. The total hours worked are then multiplied by the hourly rate to find the total amount of hours that have been worked. Finally, any deductions that need to be taken out of a paycheque are subtracted from this number. To find out how many minutes an employee has been paid for, divide the total number of minutes (from less deductions) by 60 minutes per hour.

What is the 7 minute rule for payroll?

The 7-minute rule for payroll is when a company calculates their employees’ payroll by dividing the employee’s total hours paid by the number of minutes that they worked.

The idea behind this rule was to make it easier for companies to calculate what the employees should be paid. To keep track of the hours that employees are working, some companies use a time clock while others have an employee sign in and out to keep track of their hours.

Additionally, If an employee works an extra 1-7 minutes, the time can be rounded down to the closest quarter-hour.

What is 10 minute payroll time?

10-minute payroll is a practice in which workers are given 10 minutes of paid time off per day. The idea is for workers to spend this paid time on any activity that improves their well-being and reduces their stress levels, including things such as getting some exercise or spending time with family members.

There are many benefits to the 10-minute payroll program. Workers are more productive when they return from their break and they also report feeling less stressed and more satisfied with their work.

Can I calculate my payroll taxes myself?

The short answer is: yes, but it’s a chore! How do I calculate payroll taxes without spending a huge amount on financial support is an important question for business owners, particularly smaller ones or start-ups.

The reality is that whilst it’s possible for a business owner to do manual calculations in order to work out payroll deductions, this is a time-consuming process that requires a large amount of information to be readily available.

Manual calculation may be practical where a business employs just one or two employees, but the ATO’s insistence that payroll taxes are reported each time an employee is paid (using STP), means that a third party is needed to forward the information on to ATO if the business doesn’t have appropriate software in place.

For small numbers of employees, it’s probably not cost-effective to buy payroll software. In these circumstances, we recommend using a bookkeeping professional to calculate your payroll tax.

Bookkeepers like the Geekbooks team are able to complete all your payroll tax work correctly, quickly and affordably.

When you use Geekbooks, you only pay for as much bookkeeping as you need. With prices starting from as little as $25/hour, it’s possible to have all your payroll calculations taken care of for just a few bucks, all backed by a 30 day money back guarantee.

Using a trained and certified bookkeeper enables a business to be confident that their payroll tax is being calculated correctly.

This isn’t just important in order to satisfy ATO (nobody wants an ATO audit or similar as a result of a payroll tax error), it also ensures employees won’t suddenly find that they owe large amounts of tax, due to an error on your part.

Save yourself the time and frustration of worrying about how do I calculate the taxes I have to pay for payroll and let the bookkeeping experts at Geekbooks take the strain!

Call us to find out more.